Table of Contents

ToggleIntroduction - Mandatory VAT Registration

Mandatory VAT Registration – When you are about to start a business venture in Bangladesh, one of the first questions you might have is whether you need to obtain VAT registration. Let’s answer your question.

VAT Registration Certificate (VAT 2.3 also known as Bin certificate), issued by the Tax Authority in Bangladesh, is one of the mandatory prerequisites for operating a business in the country. Without VAT registration, your business cannot legally operate.

What is VAT Registration ?

VAT Registration is the formal process of registering your business entity under the VAT & SD Act 2012. Once registered, you will be provided with a unique Business Identification Number (BIN) on the VAT 2.3 Form. Currently, BIN Certificate is required for various purposes, including opening letters of credit, obtaining trade licenses, importing products, obtaining or amending Import Registration Certificate (IRC) or Export Registration Certificate (ERC), and acquiring fire licenses for your business premises, among many others. So, in few cases, mandatory VAT registration is applicable.

Mandatory VAT Registration based on Turnover

As per Section 4(1) of the VAT & SD Act of 2012, if the actual or projected turnover of an entity exceeds the registration threshold, that entity must obtain VAT Registration. It’s important to understand that the “Registration Threshold” is defined under Section 2(57) of the VAT & SD Act 2012. According to Section 2(57), a turnover of Tk. 3 crore within a 12-month period is the registration threshold. In other words, if the annual turnover of an entity exceeds Tk. 3 crore, that entity is required to obtain VAT registration. Please note that the turnover of Tk. 3 crore can be based on actual figures or projected figures. To clarify these concepts, consider the following two examples:

Example 1

Let’s assume today is July 29, 2023. MNO Ltd. prepared its financial statements for the year ending June 30, 2022, and reported sales revenue of Tk. 40,520,000. Should MNO Ltd. obtain VAT registration?

Example 2

Now, let’s assume today is July 30, 2023. Rupali Ltd. prepared its financial statements for the month of June 2023 and reported sales of Tk. 2,500,000. However, the company’s management estimates that its turnover for the next 12 months will be Tk. 2,700,000 per month. Should Rupali Ltd. obtain VAT registration?

Solution of Example 1 & 2

The solution for both MNO Ltd. and Rupali Ltd. is the same: they are both required to obtain VAT registration based on their turnover. In the case of MNO Ltd., its actual sales exceeded the Registration Threshold, making VAT registration mandatory. For Rupali Ltd., the projected sales (Tk. 3.24 crore) for the next 12 months exceeded the Registration Threshold, so the company is also required to obtain VAT registration.

Mandatory VAT Registration irrespective of Turnover

Up to this point, we have discussed VAT registration requirements based on turnover. However, there are situations where entities must obtain VAT registration even if they have no turnover. According to Section 4(2) of the VAT & SD Act of 2012, the National Board of Revenue (NBR) has specified certain scenarios where entities must obtain VAT registration, irrespective of their turnover.

List of Mandatory VAT Registration Scenarios issespective of Turnover

(i) Supplementary Duty (SD) applicable goods or services

The entity engaged in the supply, manufacture, or import of any goods or services subject to Supplementary Duty (SD) in Bangladesh such entity is required to obtain VAT registration irrespective of turnover. Now, you might be thinking how to find information about the goods or services that have Supplementary Duty (SD). To find out which products or services are subject to SD, you can refer to the Second Schedule of the VAT & SD Act of 2012. To browse the Schedule please click on the below link:- VAT Schedules – Tax VAT Point

(ii) Participate in a Tender

The person or the entity engaged in the supply of goods or services against any contract or work order by participating in a tender is required to obtain VAT registration. In this case such person or entity must have take VAT registration. So, in this case anyone have to take mandatory VAT registration.

(iii) Export or Import Business

Engaging in export and import businesses required VAT registration. VAT registration is mandatory for both exporters and importers, serving as a fundamental step to comply with VAT obligations and contribute to the proper functioning of cross-border trade.

(iv) Branch, Liaison or project office in Bangladesh

If a foreign entity establishes a branch, liaison office, or project office in Bangladesh, it is mandatory for such offices to obtain VAT registration, regardless of their turnover.

(v) VAT Agent

To operate as a VAT Agent, individuals or entities must obtain VAT registration and secure a BIN Certificate. Without these prerequisites, individuals or entities are not permitted to function as VAT Agents.

(vi) Mandatory VAT registration as per NBR Order

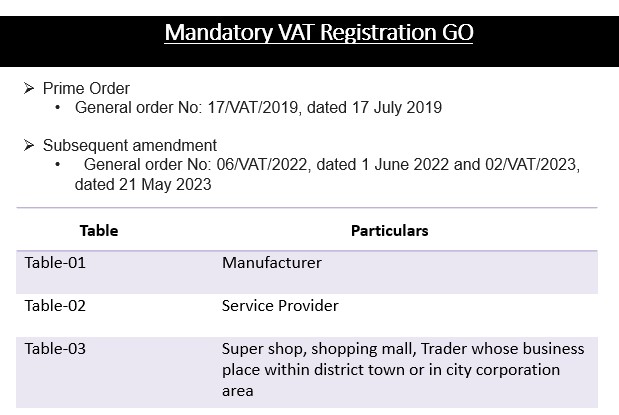

National Board of Revenue determined specific geographic areas, or supply, manufacture, or import of specific goods or services for which VAT registration is mandatory. It’s worth noting that, in this context, the NBR has already issued a General Order (GO) (General Order no 17/VAT/2019, dated 17 July 2019). Under this GO, certain manufacturers, service providers, super shops, shopping malls, and specific traders are required to obtain VAT registration. Here is the Summary of GO 17 of 2019.

Click here to browse the order: General Order No: 17/VAT/2029, dated 17 July 2029

Conclusion - Mandatory VAT Registration

In this blog post we have tried to outlined the requirement of mandatory VAT registration. Hope it will now be understandable for you where you have to take mandatory VAT registration as per VAT & SD Act 2023.

Mandatory VAT Registration - Source/ Reference:

Share on –